[ad_1]

The Walt Disney Company has reported its second quarter fiscal year 2023 earnings, beating revenue expectations but falling short of Disney+ subscriber numbers. This covers the good & bad of these results as they related to Walt Disney World & Disneyland, and why despite the strong headline performance for parks, there’s a slowdown ahead.

Disney Parks, Experiences and Products revenues for the quarter increased 17% to $7.8 billion and segment operating income increased 23% to $2.2 billion. Higher operating results for the quarter reflected increases at international and domestic parks and experiences businesses, partially offset by lower results at merchandise licensing business.

Breaking this down further, the domestic parks & resorts–Walt Disney World, Disneyland, and Disney Cruise Line–reported revenue of $5.57 billion, up by 14% over the prior-year quarter. International parks performed even better, with revenue of $1.18 billion as compared to $574 million in the prior year quarter. Consumer products, which is merchandise in general that’s for whatever reason lumped in with theme parks–and not souvenirs in the parks–actually reported slightly worse results relative to the prior year-quarter.

Before we share the results from the report, it’s worth establishing a contextual background. The Walt Disney Company’s fiscal second quarter of 2023 ran from early January to late March. At both Walt Disney World and Disneyland, this encompassed a particularly busy winter break, Presidents’ Day/Mardi Gras/Ski Week, and early spring breaks for local school districts on both coasts. It also included some softness in January and early March, but obviously did not include Easter (nor did the prior-year).

During the quarter, Disneyland opened Mickey & Minnie’s Runaway Railway and started the Disney100 Celebration with the new World of Color – ONE and Wondrous Journeys nighttime spectaculars. Disneyland also resumed Magic Key Annual Passes sales and brought back the Southern California resident ticket deal. All of this helped drive attendance.

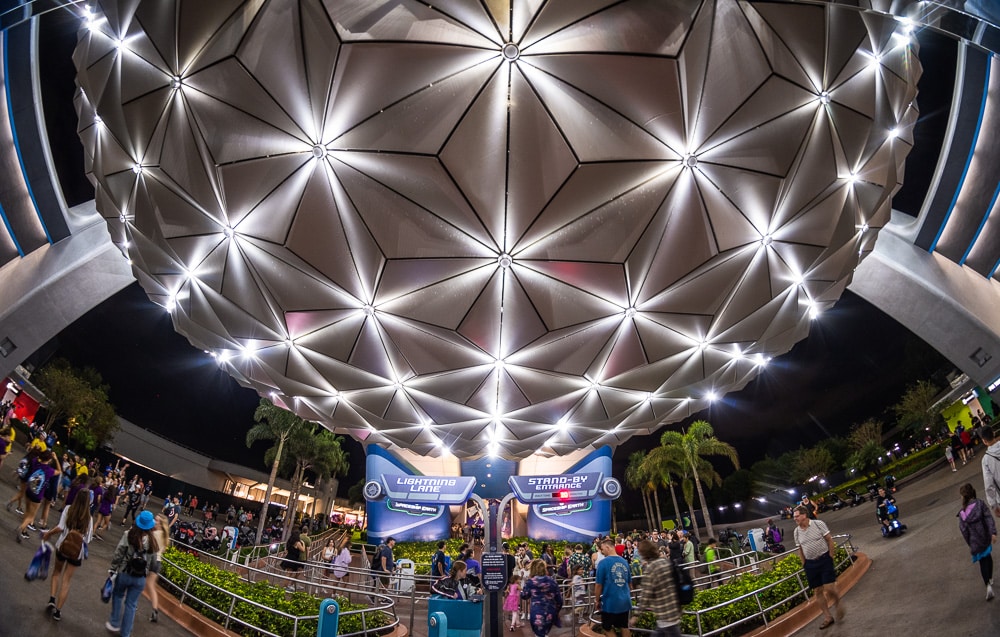

For its part, Walt Disney World released additional resort discounts–and more aggressive ones–as compared to the prior-year quarter. Technically, TRON Lightcycle Run soft opened towards the end of the quarter and had affiliation previews for about a month prior to that. Walt Disney World also had the not-so-grand finale to its 50th Anniversary “celebration.” It’s hard to imagine that either of these latter two things actually drove attendance or spending in the quarter.

According to the company, operating income growth at domestic parks and experiences was mostly attributable to an increase at Disney Cruise Line. Higher results at Disney Cruise Line were due to an increase in passenger cruise days including the addition of the Disney Wish, which launched in the fourth quarter of the prior year, partially offset by higher costs associated with our ongoing fleet expansion.

Not mentioned in the report, but Disney Cruise Line still had significant health safety protocol during the prior-year quarter. Discounts were plentiful and by anecdotal observation, the ships weren’t even close to filling up. So in other words, a big part of this 17% revenue growth for parks & resorts comes down to a favorable comparison. There will probably be a little of that in the next quarter with DCL and the international parks, but it’s gone for the domestic parks.

To that point, the company reported higher operating results at the international parks and resorts due to growth at Shanghai Disneyland, Disneyland Paris, and Hong Kong Disneyland. The increase at Shanghai Disney Resort was due to higher volumes and guest spending growth. Higher volumes were attributable to increased attendance while guest spending growth was due to increases in average ticket prices and food, beverage and merchandise spending.

The increase in operating results at Disneyland Paris was due to volume growth, which was attributable to higher attendance, and increased guest spending, partially offset by higher costs. Guest spending growth was due to increases in average ticket prices, average daily hotel room rates and food, beverage and merchandise spending.

The increase in costs was primarily due to inflation and higher costs associated with new guest offerings. Higher results at Hong Kong Disneyland Resort reflected more operating days in the current quarter due to COVID-19-related closures in the prior year quarter.

Finally, the company reported results at domestic parks and resorts that were slightly unfavorable to the prior-year quarter, as a decrease at Walt Disney World Resort was largely offset by growth at Disneyland Resort. The decrease at Walt Disney World Resort was due to higher costs, partially offset by increased volumes. Higher costs reflected cost inflation, increased expenses associated with new guest offerings and higher depreciation.

The increase in volumes was due to attendance growth and higher occupied room nights. Increased operating income at Disneyland Resort resulted from growth in attendance and guest spending, partially offset by higher costs. Higher guest spending was due to increases in average ticket prices and average daily hotel room rates. The increase in costs was primarily due to higher operations support costs and increased costs associated with new guest offerings.

During the Q&A, CFO Christine McCarthy mentioned Genie+ and Lightning Lanes as a driver of per guest spending increases, but also noted that it started to moderate because the comparison was against the first full quarter of offering Genie+ and Lightning Lane at both parks in the prior year. She declined to offer a percentage, but gone are the days of boasting about 40% increases in this beloved metric.

This doesn’t tell the full story. Investors who are not park enthusiasts probably take this at face value, but the obvious distinction between this quarter and last year is date-based pricing for Genie+ at Walt Disney World. On average, the daily cost of the Genie+ was up significantly in the quarter; prices ranged from $15 to $29, but there were fewer than 10 days during the quarter at the $15 base price.

This is especially interesting because both attendance and hotel occupancy were up at Walt Disney World, meaning that more people were spending less. The easiest explanation for this is that average daily hotel rates were down; this explanation makes sense on its face, and is more or less confirmed by Disney not saying otherwise (like they did for Disneyland). But it would also stand to reason that fewer guests were purchasing Genie+ at the higher prices or buying less merchandise or otherwise cut something from their vacation budgets.

McCarthy also gave words of warning about the coming quarter (April through June) at Walt Disney World: “Please keep in mind that in the back half of this fiscal year, there will be an unfavorable comparison against the prior year’s incredibly successful 50th anniversary celebration at Walt Disney World. We typically see some moderation in demand as we lap these types of events, and third quarter-to-date performance has been in line with those historical trends.”

Readers, please keep in mind that the goal of these earnings calls is to frame things in the most favorable light possible to Wall Street, while being careful not to run afoul of the SEC or present something that strains credulity in the eyes of investors. (The latter was part of Chapek’s downfall, as he attempted to spin a clear negative into a positive during his last earnings call.)

Again, this is a scenario where you are likely more knowledgeable than the average investor; it’s safe to say that most of you would call BS on the claim that the “successful” 50th Anniversary Celebration was a major driver of attendance in the second half of last year. Even if you give the benefit of the doubt and assume the 50th marketing was still doing its job to some degree, that has been supplanted by the return of Happily Ever After, opening of TRON Lightcycle Run, and kickoff of the Disney100 celebration. I don’t know about you, but I have a difficult time believing that halfway into its run, the 50th had more drawing power than all of that has or will have.

Obviously, McCarthy is not going to come out and say that attendance and bookings are soft for the remainder of the fiscal year, even after they’ve brought back Annual Passes and started getting even more aggressive with discounts. Honestly, though, I am a bit surprised the softness wasn’t at least attributed to an externality: exhaustion of pent-up demand. (A phenomenon of which every investor on the call is aware as it has been discussed by most other similarly-situated companies.)

Perhaps Disney didn’t want to imply that the performance of the last couple years is a thing of the past? That could explain framing this as a blip while lapping the 50th. Regardless of the reason, preparing investors for an unfavorable comparison is a move to ‘soften the blow’ before next quarter’s results arrive and underwhelm. Given that Walt Disney World already slightly underperformed in the current quarter, when there were no obvious signs of a slowdown in the parks, it’ll be interesting to see what happens with April through June.

We’ve already discussed post-spring break attendance trends in Sharp Shoulder Season Slowdown at Walt Disney World and Low Pre-Summer Crowds at Walt Disney World. Despite the deluge of disagreeing comments on Facebook (first rule of Facebook: Walt Disney World is *always* busier than ever), there has been a significant slowdown in the past several weeks.

This trend is typical between spring break and summer, but the degree to which it’s currently occurring is not. The parks are slower right now–and that goes for both coasts–than they were at the same time last year or in 2021. It’s undeniable and obvious. (I’m sorry if you encountered large crowds at either in the last few weeks, but there has been a drop.)

Looking forward, there are other signs of softness. As we’ve mentioned repeatedly, Walt Disney World already has released 14 different discounts for 2023, which is more than were available for the entirety of last year. Most of these discounts have been released earlier than normal by historical standards, and offer better savings than their counterparts from the last two years. Some are superior to 2018 or 2019, but baseline prices and perks have also changed since then.

We’ve also heard anecdotal reports that, despite the discounting, resort occupancy numbers are still below expectations for this summer. This explains why Walt Disney World has started pulling “levers” to help give demand a shot in the arm and buoy bookings. One lever is new Annual Pass sales resuming. (Remember Disney’s warning that tiers were expected to sell out on launch day? Several weeks later, everything is still available.)

It wouldn’t surprise me if more summer ticket deals are released for Floridians or DVC members, and perhaps more targeted room deals. One outside possibility is a summer celebration or surprise entertainment. We’ll know things are bad if Disney trots out the tired old Main Street Electrical Parade, which is the telltale sign of soft demand.

This is also part of the motivation in making 5 major changes to improve the guest experience when announcing 2024 Walt Disney World vacation packages. Obviously, that doesn’t do anything about the immediate future, but it should help with next year’s bookings. It stands to reason that if pent-up demand has fizzled out for this summer, it’s also impacting future quarters and years.

Another reason McCarthy’s ‘warning’ was more measured is because the situation is still pretty far from dire. This will be painted as a five-alarm fire by those cheering for Disney’s downfall, but that’s not reality. A slowdown from unprecedented demand is not a catastrophe, it’s a normalization. Of course, Walt Disney World would’ve loved to maintain record-breaking numbers or that growth trajectory, but even internally, they knew a slowdown was on the horizon.

All of this is what we’ve been expecting and hoping to see for a while. Pent-up demand lasted longer than I anticipated, and frankly, it was a distortion that had unhealthy consequences for the broader economy (beyond Disney). Putting that in the rearview mirror may be bad for the company, but it’s good for consumers and the country as a whole. Walt Disney World not doing record-breaking numbers regardless of the guest-unfriendly decisions and changes they make–and instead having to actually compete for customers–is very much a good thing.

Other stuff was said on the call, with the most noteworthy topic to investors being the Disney+ streaming service. I don’t want to fixate on this too much since this is a parks-centric blog, but there’s no avoiding the reality that Disney’s streaming services have an outsized impact on everything else–including investments at Walt Disney World and Disneyland.

Analysts had expected Disney+ subscriptions to reach 163.17 million users, growth of <1%. Instead, Disney+ saw a loss of 4 million subscribers to 157.8 million–a decrease of roughly 2%. Confirmation bias being what it is, many “fans” are going to point to this drop and attribute it to questionable content decisions or [insert personal grievance].

In reality, unless your personal grievance involves cricket (the sport, not the bug) that isn’t the real explanation. Disney ceded the expensive rights to Indian Premier League, which has resulted in an exodus of subscribers from India. That’s why the majority of the above-referenced losses came from an 8% drop in subscribers at India’s Disney+ Hotstar.

This doesn’t really matter, though, because Hotstar is super cheap. As Disney+ has shifted from a growth at all costs mentality to one focused on profitability and sustainability, more of this type of thing will happen. The company will keep pulling back spending in regions that were never economically viable in the first place.

Revenue for streaming rose 12% to $5.51 billion for the quarter, reflecting recent price increases. The company also saw higher subscription revenue at Disney+, where average revenue per user rose 20% to $7.14 for domestic subscribers. This gain was offset by a 20% fall in revenue for Disney+ Hotstar, which pushed global Disney+ ARPU to just $4.44.

On a positive note, Disney’s streaming losses were smaller than expected, with a loss of “only” $659 million during the quarter, compared to a loss of $841 million projected. This is the first quarter in a while that number has been under $1 billion. That’s probably the most meaningful number from our perspective, as the company doesn’t have much leeway for major capex investment at Walt Disney World or Disneyland until streaming stops hemorrhaging money and some debt is paid down.

Disney also announced that it would add Hulu content to the Disney+ streaming service, while also announcing it would raise the price of its ad-free streaming service later this year. Integrating Hulu into Disney+ suggests to us that Disney intends upon buying out Comcast’s stake in the streaming service. Between this and everything else, the odds have increased of Disney spinning off ESPN. (Just my personal take–not discussed on the call.) That could also be good news for future investment at Walt Disney World and Disneyland.

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

What do you think of Walt Disney Company’s Q2FY2023 earnings and future forecast? Surprised that Disney+ lost 4 million subscribers, or unconcerned about cricket? What about per guest spending at Walt Disney World and Disneyland, or other theme park results? Thoughts on a slowdown at Walt Disney World or Disneyland? Predictions about other “levers” the company will pull to boost demand and buoy bookings? Think things will improve or get worse throughout this year? Do you agree or disagree with our assessment? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!

[ad_2]

Source link