[ad_1]

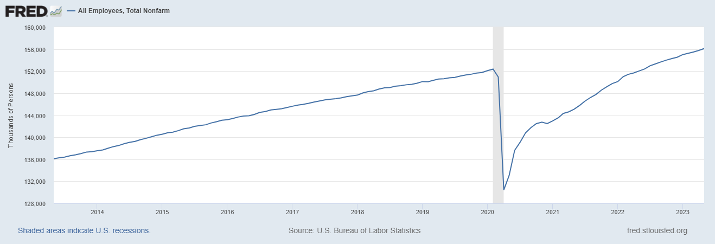

Currently, we stand at 156,105,000, so I consider we are still in make-up method until we arrive at a array suitable to a rapidly economic recovery.

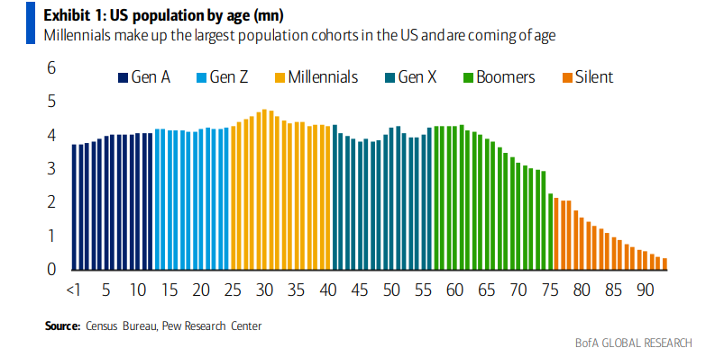

That’s why the positions facts has beaten anticipations 14 months in a row. What the U.S. has that other nations around the world never is a massive younger workforce. Although inhabitants advancement is slowing below, we have the demographic muscle that other international locations do not have — if we did not have that, our financial dialogue would be distinct.

Now let’s seem at the labor market place on all fronts from the information we got this week to get a thorough view of the labor marketplace now. On Friday the BLS reported job growth came in at 339,000, with good revisions, while the unemployment rate went greater, as there was a fall in self-utilized staff.

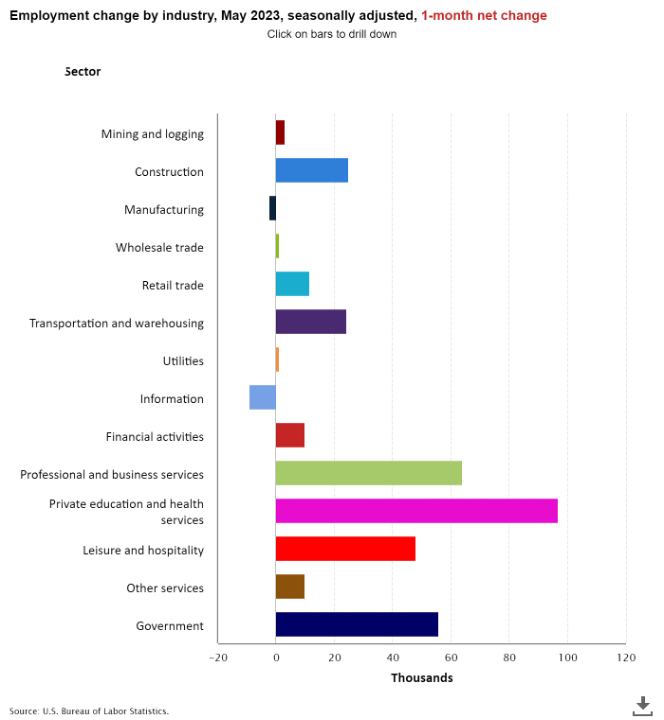

From BLS: Overall nonfarm payroll work enhanced by 339,000 in Might, and the unemployment level rose by .3 proportion position to 3.7 per cent, the U.S. Bureau of Labor Statistics reported now. Career gains transpired in specialist and business enterprise providers, federal government, health and fitness treatment, construction, transportation and warehousing, and social assistance.

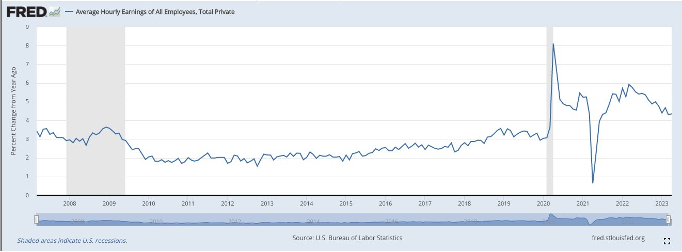

Hrs worked have fallen in the final number of months, and wage development is slowing. The concern of 1970s-type inflation was that wages could improve out of handle in a tight labor market place. In concept, 2022 and 2023 are restricted labor marketplaces and wage advancement is slowing down. This craze really should carry on for the following 12 months as nicely.

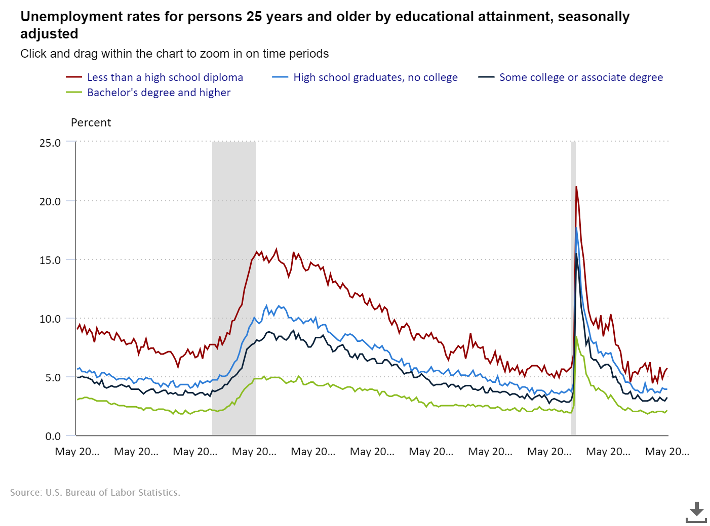

In this article is a breakdown of that facts for people aged 25 and more mature:

- A lot less than a significant school diploma: 5.7% (2 months back, 4.8%)

- High faculty graduate and no higher education: 3.9%

- Some school or affiliate degree: 3.2%

- Bachelor’s degree or higher: 2.1%.

The apparent details line right here is that the unemployment level for individuals without the need of a superior faculty education and learning is up practically 1% from two months in the past.

Listed here is the breakdown of the careers produced this month, an additional big month for the governing administration, which commonly doesn’t proceed at this tempo. Construction labor has held up pretty well, even nevertheless housing permits have been slipping for some time. The backlog from COVID-19 has been a careers system for the U.S. as we are nonetheless gradually developing the housing completion data.

So the BLS jobs report is nonetheless pushing together, when wage growth is slowing down. Jobs Friday is 1 piece of the labor pie — we have two other knowledge lines that we generally require to retain an eye on to know the overall health of the labor sector: work openings and jobless promises.

As the only man or woman on Earth who talked about job openings data having to 10 million in this recovery, I am amazed that task openings knowledge is still around that mark. But that is off the modern highs of 12 million.

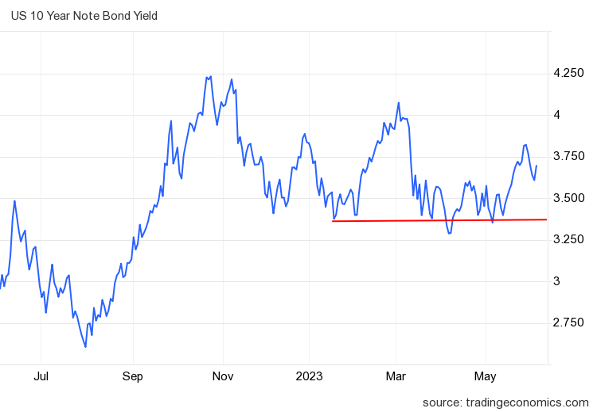

At this point of the financial enlargement, I am placing more excess weight on jobless statements data than job openings (JOLTS). For me, the Fed doesn’t pivot, or the 10-year generate does not crack underneath 3.21%, till jobless claims split more than 323,000 on the four-week moving common, and that isn’t happening both.

As we can see under, the Gandalf line in the sand has held up the entire yr, even although it was examined quite a few times.

As we can see underneath, the jobless claims four-7 days going regular is even now far from breaking around 323,000. I selected that variety working with several distinct variables as I feel when we crack about that stage, it will be recognizable to every person — even the Fed — that the labor market place has broken.

From the St. Louis Fed: Original promises for unemployment insurance advantages improved by 2,000 in the 7 days finished May 27, to 232,000. The four-week transferring typical declined, to 229,500.

It is significant to recognize the labor dynamics of this financial growth. We had such a shock in the economic system with COVID-19 and a sturdy labor market place restoration that the make-up labor need, which does not get talked about a great deal, is a significant motive we continue to see balanced figures.

Also, it’s crucial to understand the demographic variance now and what we experienced to deal with just after 2008. The Newborn Boomers are leaving the labor sector, and every thirty day period that takes place, they have to have to be replaced if demand is growing. This is why having a balanced selection of young workers not only will help with that but also provides alternative consumers, as those who go away the labor current market tend to eat a little bit otherwise than more youthful workers.

At this stage of the economic cycle jobless promises is the details line that issues most. The moment jobless statements split over 323,000, then and only then I believe we can converse about a Fed pivot — very first in their language and then perhaps with charge cuts.

The Federal Reserve is frightened to demise of the 1970s inflation, and they genuinely feel that breaking the labor marketplace is the greatest way to stop that sort of inflation from occurring. As a nation, we are combating versus a team of people caught in the mistaken ten years with their financial state of mind on inflation.

[ad_2]

Supply backlink