[ad_1]

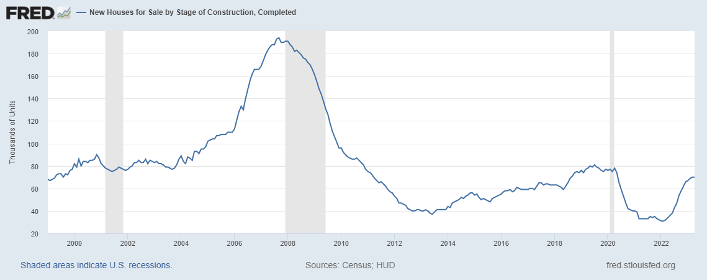

In a place with additional than 330 million persons, there are only 70,000 new homes offered for sale currently in the U.S. housing industry. And with overall lively home listings in The united states near all-time lows, that is all we have for finished models for sale.

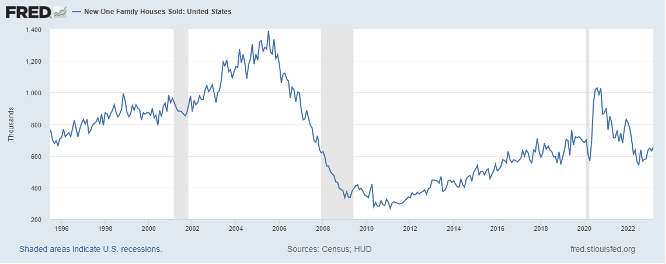

The number of new homes doesn’t ever get into the tens of millions, but we are nevertheless operating our way back again to the pre-COVID amounts of 80,000 to 100,000. As we can see in the chart under, the builders are acquiring back again to a far more regular selection when their gross sales information have stabilized.

Why have the homebuilders’ shares carried out so well lately? The builders are just relocating product or service, carrying out whatsoever it will take to offer their households and stabilize new home profits, and that is what we have noticed in today’s new residence revenue report.

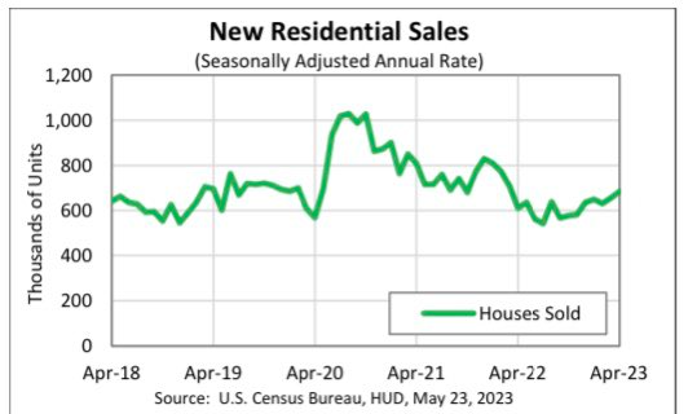

The new dwelling income report has been the similar story for pretty much 18 months, with household product sales stabilizing from a reduced degree.

From Census: New dwelling sales: Revenue of new single‐family houses in April 2023 were at a seasonally modified yearly charge of 683,000, according to estimates launched jointly right now by the U.S. Census Bureau and the Division of Housing and City Enhancement. This is 4.1 per cent (±11.8 percent)* over the revised March amount of 656,000 and is 11.8 p.c (±15.1 %)* previously mentioned the April 2022 estimate of 611,000.

Previous 12 months, when the Census Bureau was reporting the new household gross sales quantities and the builders had been having substantial cancellation costs, the regular revenue report did not account for the cancellations of contracts. This can make the monthly experiences better than normal, so taking that into thought, the new residence sales numbers ended up definitely low previous yr.

Last year, sale ranges were being meager and once house loan fees fell and the builders were being obtaining down costs to get a lot more households marketed, the details stabilized and moved increased bit by bit. To give you an strategy of the percentage of houses exactly where the builders were giving a get-down, the main economist of the Nationwide Affiliation of Home Builders, Robert Dietz, tweeted out this info line on Tuesday: “21 pct of builders used mortgage price purchase downs in April. It was 33 pct previous Tumble. More very likely massive builders.”

On the lookout at new house income with an historical context, you can see that we weren’t performing from a superior bar final yr on gross sales. So, the bar was very very low to just have demand from customers stabilize as charges fell, much like the current dwelling income current market. We also have a large amount far more staff now than what we did back in 1996 — the stage wherever new dwelling revenue had been trending very last calendar year.

Just like with the existing household profits market place, all that is happening is that household income stabilized from a minimal amount.

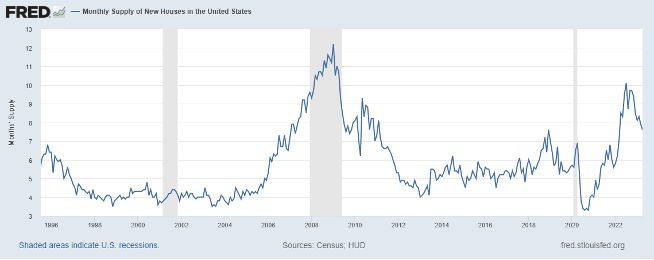

This is various from the 2007 housing sector when the builders’ sales ended up nevertheless collapsing and month-to-month source spiked with rising cancellation prices. The reverse is going on now cancellation costs have been falling from a high stage and month to month provide is falling.

I have a clear-cut product for when the homebuilders will begin issuing new permits with some kick and length. My rule of thumb for anticipating builder conduct is centered on the a few-thirty day period supply regular. This has nothing to do with the present property income sector — this regular supply facts only applies to the new property gross sales sector, and the latest 7.6 months are also significant for the builders to issue new permits with any natural steam.

- When supply is 4.3 months and down below, this is an fantastic market place for builders.

- When supply is 4.4-6.4 months, this is just an Okay market place for builders. They will build as prolonged as new house profits are escalating.

- When supply is 6.5 months and above, the builders will pull back again on building.

From Census: For Sale Inventory and Months’ Source: The seasonally altered estimate of new houses for sale at the close of April was 433,000. This signifies a provide of 7.6 months at the recent income fee.

When we talk about the month-to-month provide facts, we need to crack it into subcategories for the reason that the 7.6 months has perplexed lots of men and women.

- The Stock for houses done is at 70,000 = 1.23 months of offer.

- The Stock for households below design is 263,000 = 4.6 months.

- The Inventory for houses that have not begun however is at 100,000 = 1.8 months

As you can see, we don’t have a great deal of new properties ready to go — we have an abnormally high number of new properties however in design and the builders don’t just ramp up generation till they know they can provide people households for a financial gain. I am skeptical of any massive choose-up in housing permits till we exceed 6.5 months of source and new household product sales rise.

So, if you are puzzled about housing however being in a economic downturn whilst were being supposed to have been in a bubble crash final year — only to see the builders carrying out Ok with the details earlier mentioned, I do not blame you. Typically, with a housing bubble crash, you really don’t have new house gross sales stabilizing, cancellation fees slipping, regular supply slipping and mounting builders’ assurance. These economic facts traces really don’t take place when we are in a housing bubble crash yr.

The authentic story is that active listings are still incredibly small historically, the builders had and however have a significant backlog of homes to end and get marketed, and they are performing by way of that backlog. They can do this by chopping price ranges and shopping for down rates, as I think they are efficient sellers.

Now that mortgage loan rates have strike 7%, the question is irrespective of whether the builders can carry on to hold this slow uptrend in sales heading. The housing market place has not responded properly with 7% additionally mortgage loan prices and this is now the 3rd time this has occurred since the large run-up in mortgage prices in 2022.

[ad_2]

Source website link