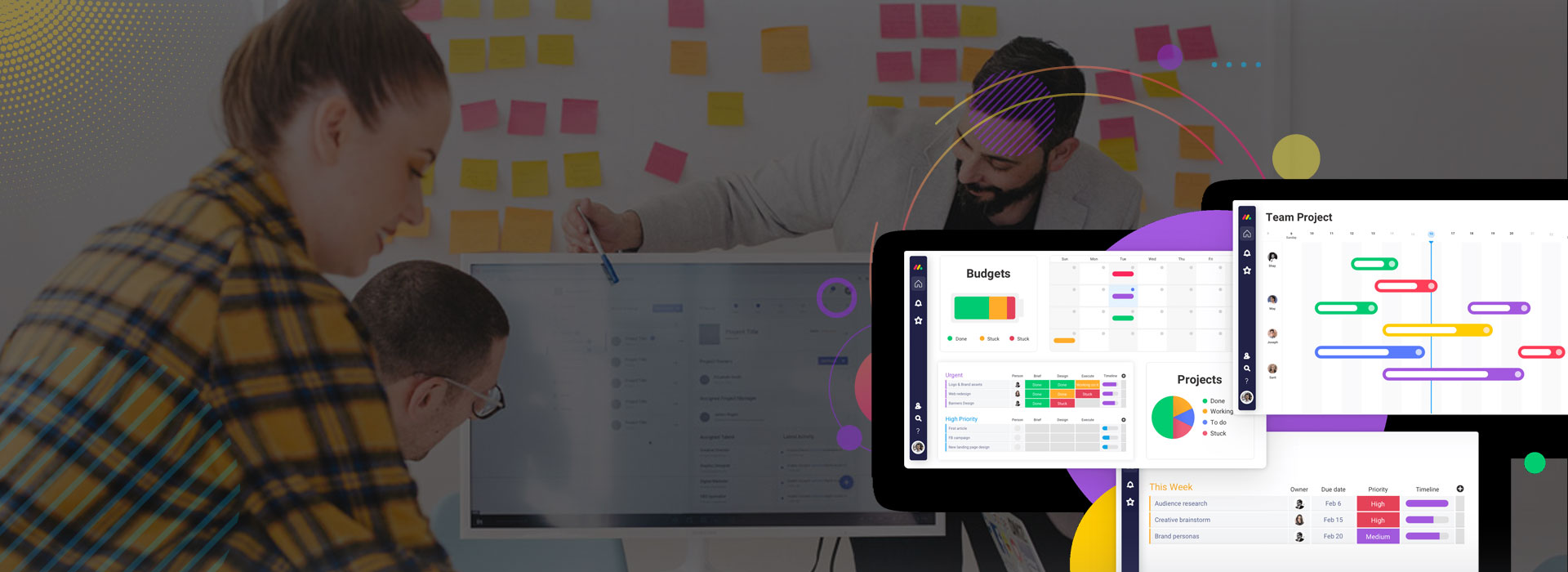

The monday.com integration with QuickBooks is a match made in heaven. With complementary capabilities, the combination streamlines and enhances various aspects of any business operations, especially when it comes to financial management. From automating the transfer of data surrounding invoices, expenses, and transactions to generating credible and accurate financial reports – the QuickBooks monday.com integration can deliver it all.

The synergistic ecosystem is a boon for Chief Financial Officers (CFOs) with a growth mindset and would rather focus on building strategies than crunching numbers. The cohesiveness injects efficiency, time and effort savings, resource optimization, and transparency for sharper financial control within the organization.

Monday Integration With QuickBooks: Use Cases Across Industries

Here are some illustrative use cases for using monday QuickBooks integration across different industries and sectors:

-

Retail: Integrate monday with QuickBooks for seamless inventory management. Automatically sync sales data, track inventory levels, raise stock requests, reconcile transactions, and more. The integration ensures timely restocking while maintaining accurate financial records.

-

Manufacturing: Use monday QuickBooks integration to streamline the procurement process. Automate purchase order creation, track production costs, and maintain a record of all financial data for cost-effective manufacturing.

-

Healthcare: Integrate monday.com with QuickBooks to manage patient billing with ease. Streamline invoicing, track patient expenses, automate payment reconciliation, etc. to offer patients a hassle-free transaction experience while maintaining effective control over finances.

-

Real Estate: Simplify financial management of properties with monday.com QuickBooks integration. From tracking rental income to automating invoice generation for property-related expenses, the integration helps users maintain robust financial records of every property.

Business Benefits of Monday QuickBooks Integration

Best Practices for Monday QuickBooks Integration

Here’s an in-depth look at some best practices of monday.com QuickBooks integration to help businesses achieve more:

Understand the Finance Processes

Before embarking on the monday QuickBooks integration journey, you must have a clear understanding of your current finance processes. For this, you must understand how your teams are currently using QuickBooks and monday.com, what data you want to sync with monday.com, how the end-users want to integrate monday.com with QuickBooks, where the invoicing will be sent out from, etc.

Select an Integration Method

Now that you have an understanding of your finance processes, you must align on clear objectives and select an apt monday.com QuickBooks integration method. Several integration methods are available, such as API-based integration, third-party connectors, and custom scripts. A survey indicates that 60% of organizations use an API-based integration approach, making it the most preferred method. As such, API-based integration allows QuickBooks and monday.com to directly communicate with each other, thereby enabling seamless data transfer and synchronization. Apart from reducing latency, this approach also ensures data integrity. All in all, the preference for API-based integration is not merely a technical inclination but a strategic decision to generate significant operational advantages.

Prioritize Data Security and Accuracy

The data involved in monday.com integration with QuickBooks is likely highly sensitive or confidential. The high value proposition of this data makes it susceptible to cyber threats. Seeing how finance and insurance organizations around the world experienced 566 security breaches in December 2022 alone, resulting in 254 million leaked records, businesses must stay vigilant. To ensure the security and privacy of sensitive information, you must to various security measures such as data encryption, authorization protocols, role-based access control, etc.

Furthermore, it is critical to maintain the accuracy of financial information. To that end, you must conduct a regular audit of the data between monday.com and QuickBooks. Data validation checks will help detect discrepancies and maintain the integrity of financial information.

Automate Data Entry and Customize Workflows

25% of any C-suite leader’s time is spent on tasks that can be machine-automated for efficiency, accuracy, and relevance. This means that custom workflows are a must-have for digital solutions revolutionizing the finance industry. Fortunately, both platforms support extensive customization options. The same spills over to QuickBooks monday.com integration. It has a cascading effect that amplifies the business’ ability to tailor workflows to match specific processes and workflows. The resulting value alignment ensures that the integration enhances existing operations rather than hindering them.

Monitor and Audit Regularly

Integration is never a one-time “set it and forget it” thing. They have to be tested from time to time to ensure that the financial data moves seamlessly across platforms. As such, make it a habit to regularly monitor and audit monday.com QuickBooks integration to test for accuracy, reliability, and security of the financial data. Doing so helps businesses identify and rectify any discrepancies, errors, or data drop-offs that may arise during the transfer process. Such proactive assessment maintains the integrity of financial records while bolstering the risk of making poor financial decisions based on low-quality data. It also sheds light on any potential security threats or vulnerabilities that could upend financial processes.

Conclusion

In summary, monday.com integration with QuickBooks can be an asset in putting finance professionals at the helm of prudent financial management.

However, for the integration to have a compounding effect, businesses must pay close attention to certain best practices to maximize outcomes. Considerations like taking stock of existing finance processes, preparing a comprehensive integration roadmap, prioritizing data security and accuracy, customizing workflows, offering onboarding, support, and training, and monitoring and auditing processes routinely can be pivotal in helping the QuickBooks monday.com integration take off. With these strategies, businesses can be assured of making the best of such a fruitful combination.