[ad_1]

Insurance plan is a single of the several industries that have remained mainly unchanged above the previous several a long time at a small degree: You endure losses as a direct result of anything heading south, and you get compensated by your insurer.

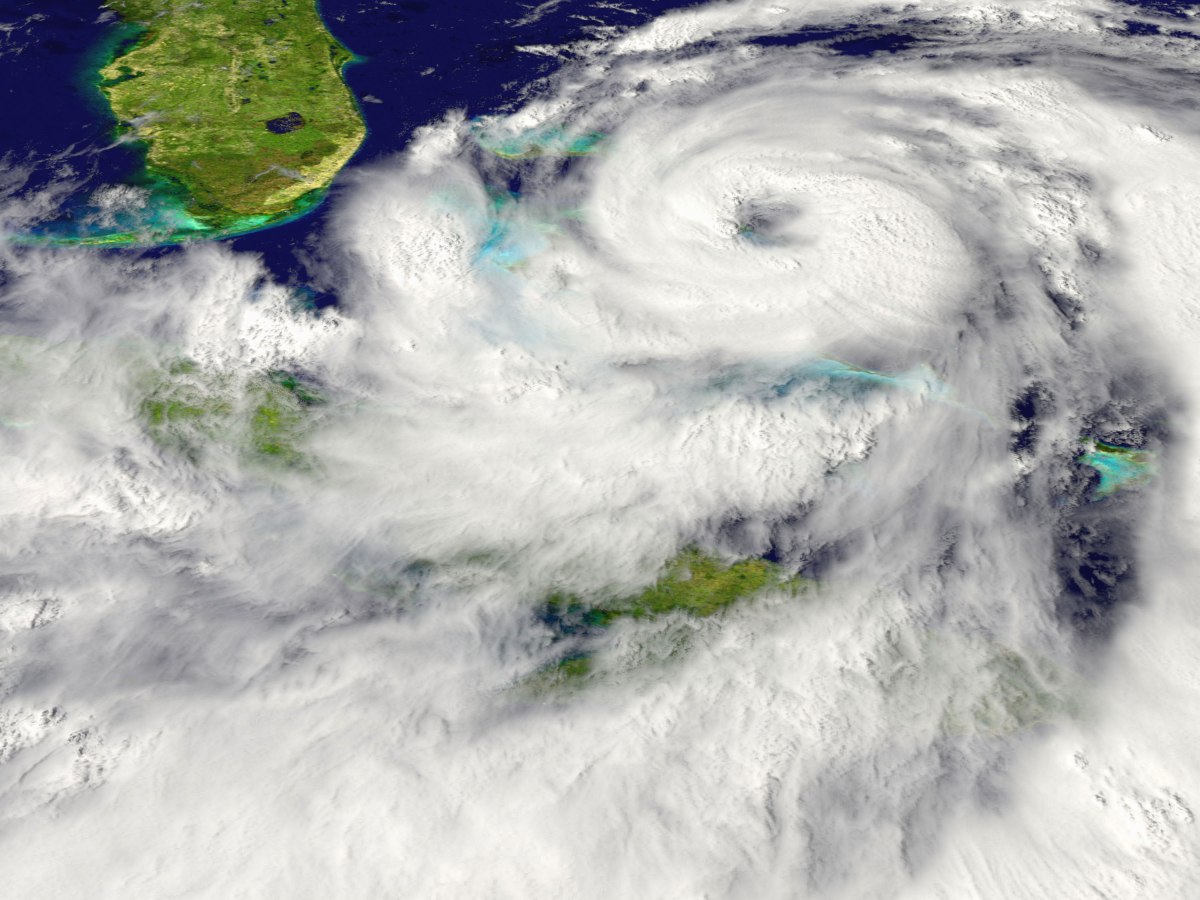

But that old design does not always operate. For illustration, a construction organization in a area regularly affected by hurricanes may possibly see its projects surviving these storms typically unscathed, but it may possibly continue to see losses in terms of time and other probable prices for the reason that crews simply could not make it to get the job done.

Your regular indemnity coverage could possibly fork out this firm centered on the magnitude of its losses, but would not have to pay for all those unforeseen, follow-on fees because they aren’t “damages” in the typical perception. One particular could argue the firm is getting the shorter end of the adhere below.

Parametric insurance plan, on the other hand, ensures that all people can get. Instead of insuring prospects dependent on the magnitude of the losses incurred, parametric contracts insure clients towards the magnitude of occasions. So in our illustration, the building firm may possibly see a payout if there is a specific “trigger occasion,” this sort of as the place is hit by a Group 4 hurricane or better, or if the wind pace reaches a specified, pre-specified mark.

Trader Nina Mayer, a principal at Earlybird Undertaking Money, outlined it fairly succinctly in our current insurtech study:

“Parametric insurance coverage (as opposed to classic indemnity insurance policy) is an insurance style that pre-specifies the sum of payout based on concrete ‘trigger’ activities. For case in point, the payout could be connected to a sure weather celebration, these types of as the height of a river previously mentioned the flood stage.”

This sort of insurance coverage is also identified as index-based insurance policy mainly because it relies on data and automation, a blend that points out why this solution is having fun with tailwinds. As a substitute of filing and examining promises, the two functions can count on facts demonstrating that a set off event occurred.

Leveraging details in this way will make the course of action a lot more successful for both of those the insurance provider and the insured. “The crucial pros of parametric insurance plan are rapidly payouts, significant overall flexibility and the option to offer protection for losses that are complicated to model,” Mayer claimed.

The rapid payouts that this model facilitates make it significantly helpful for weather-similar insurance policies, in which people influenced are most benefited by brief access to money. And that is plainly evidenced by the number of insurtech startups setting up parametric methods for this place.

[ad_2]

Resource website link